Top 4 Insurance Risks for July 4th

The Fourth of July can be an exciting time to celebrate our nation’s history. On Monday, many of us will get off work and celebrate with friends and family – grilling burgers and brats, hosting parties, and lighting fireworks. Unfortunately, this holiday can also be dangerous and should be treated with caution. There are a variety of insurance claims that occur on July 4th, some […]

Small vs. Large Insurance Carriers

With Thanksgiving right around the corner, allow us to use this analogy to describe small vs. large insurance carriers. No one wants a small turkey for their family, you want quality meat at an affordable price that can feed everyone. Same with insurance, a policy that is affordable and provides adequate coverage should be the goal for a new auto, home or renters policy.

Why Home-Sharing May Not Be Insured By Your Policy…

Travelers using Airbnb and HomeAway look to fully immerse themselves in the culture of a city by sharing the home of a local host, while a host makes some extra cash by allowing a stranger to stay with them. As the popularity of a ‘sharing economy’ increases in our society, it’s important to be armed with all of the facts when it comes to participating […]

Top Places To Propose In Lubbock

According to the Lubbock county clerk, “millions and millions” of marriages have been performed in Lubbock County since its incorporation in 1881. You can even find Buddy Holly’s marriage certificate in the hard copies on file at the courthouse. The mechanics of maintaining all of these hard copies, and of building digital databases is enormous.

How Insurance Might Work in the Star Wars Universe

Pop culture is rich with references to movies. Every school kid, to this day, recognizes the ominous interval warning of an imminent shark attack, thanks to “Jaws”. Among the many influential movies that have impacted our culture, “Star Wars” is the only one with its own date. May 4th is Star Wars Day, as in May the Force Be With You? We’re also looking forward […]

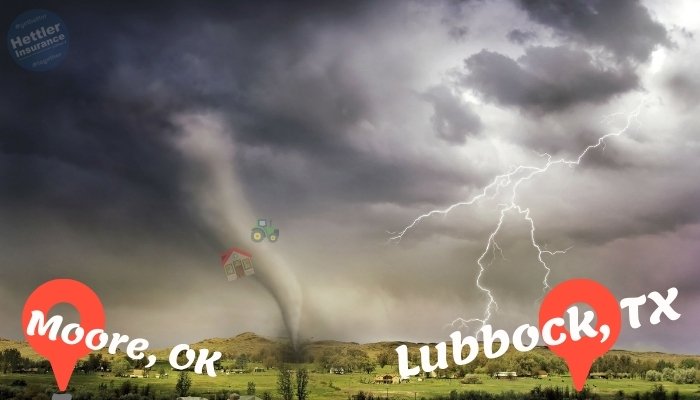

Could Lubbock, TX Have the next Moore, OK tornado?

Tornado! The mere word conjures up fear. Lubbock, TX has experienced 92 tornadoes over the past 56 years according to http://www.tornadohistoryproject.com/tornado/Texas/Lubbock Lubbock averages more than one tornado in the county each year. So there’s no question that we have an abundance of activity that regularly strikes our town.

Which Deductible Should I Buy?

Low deductibles are great when the claim occurs but rarely are they the best long term decision. O.K. Let’s start this discussion with a trip to Las Vegas. Odds are, if you are reading this, you don’t live in Vegas so a trip is within the sphere of imagination for you. See this decision is all about odds.

New Client’s Home and Auto Insurance savings are $1,300 HUGE!

So I was at the Lubbock, Texas Parade of Homes last week and saw a friend that said he wanted to call me about his home and auto insurance. He called me that following Monday and a couple of days later, Hettler Insurance wrote his auto insurance policy. I didn’t know what he was paying through his long time agent, but I did know that […]

Should you shop your Auto Insurance and Home Insurance coverage together?

We get calls all the time from families wanting us to shop their auto insurance. We put all the information into the rating program and get quotes back from up to 8 companies. But many times the substantial savings that we show the customer is “eaten up” by the loss of a multi-policy discount on their home insurance.

Why should I insure my home for replacement cost?

Over and over again for the past 30 years, I have heard the complaint that the amount of coverage on my home on my homeowner’s insurance policy is way more than the home’s market value. Sometimes you insure even a newly constructed home for more than what you just paid! A seemingly excess amount of coverage is a valid concern because it seems a bit unethical to insure your home for […]

Hartford to launch new homeowners policy

On July 9th, 2011, Hartford Insurance has announced they will begin offering a new home protection product. This new policy will have the option of covering mechanical systems such as air conditioners and refrigerators for mechanical breakdown. (Refer to policy for complete details.)