All Texans know that we live in the greatest state on earth. As such, we don’t like to be bothered by problems that divert us from advancing our business, socializing or just relaxing with some Friday night football. So it’s no wonder that many folks don’t want to face the frightening and highly inconvenient problem of climate change. But it’s here, and a spate of recent weather extremes are affecting the insurance industry.

Don’t Get Hung up on Politics

For as long as possible, politicians on both sides denied that the climate was changing. Understandably, they didn’t want to alienate business interests that would be impacted by massive restrictions. Overwhelming scientific evidence has now convinced all but the staunchest deniers to admit something is going on with the climate. In Texas, our mostly conservative leaders now admit that climate change is real. However, several still hold onto the assertion that humans aren’t causing the change, so regulations are unnecessary.

Are we responsible or not? Sure, it’s an important question, especially if you’re setting policy or even just deciding what type of car to buy. But when it comes to choosing insurance, the politics behind global warming doesn’t matter. Instead, you need to look at whether your home and property will be on the path of the next Katrina, Sandy or 1,000-year flood.

Insurance Carriers Are Already Affected

Leaders in the insurance industry are taking weather changes associated with global warming very seriously. As reported in Fort Worth’s Star Telegram, Travelers’ first quarter profit dropped 17 percent this year because of Texas hailstorm damage. Progressive and Allstate also took hard hits. The Insurance Council of Texas estimated that a single San Antonio hailstorm caused almost $1.4 billion in damage, making it one of the costliest in our great state’s history.

Obviously, insurers can’t afford to ignore climate change. The National Association of Insurance Commissioners has a Climate Change and Global Warming Working Group. Its number one goal for 2016 is to review the enterprise risk management efforts by carriers and how they may be affected by climate change and global warming, according to the NAIC website. Other aims include investigating the use of climate change modeling by carriers and reviewing new insurance products related to global warming.

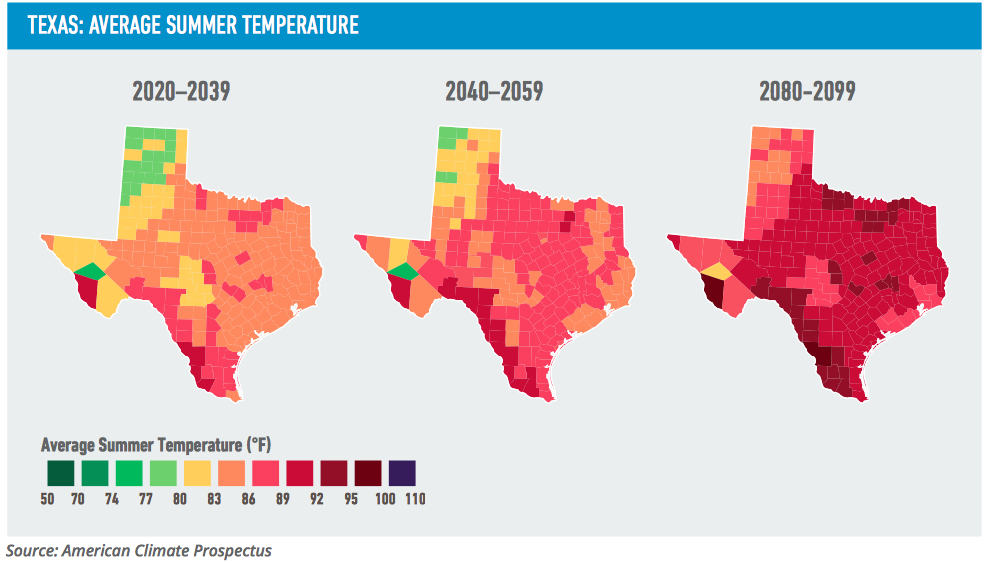

The Texas Climate of the Future

A 2015 report called “Come Heat and High Water: Climate Risk in the Southeastern U.S.” concluded that Texas will be especially impacted by climate change. Dire predictions for 2050 Texas include:

- The number of days with temperatures exceeding 95 degrees will skyrocket from the current average of 43 to a blistering 106.

- About 4,500 more people will die of heat-related causes per year

- The sea level will rise up to two feet in Galveston

- Storm damage to Texas’ coast will increase approximately $650 million per year

- Crop yields and worker productivity will decline

Kerry Emanuel, a professor of atmospheric science at MIT, studies the rising ocean temperature’s effect on hurricanes: They get worse. Expect more powerful hurricanes, he told State Impact, with greater damage along the Texas coastline. Emanuel predicts that the hurricanes will bring periods of intense rainfall and flooding, alternating with long droughts.

Of course, this being Texas, some political leaders downplay global warming reports and question the accuracy of climate change modeling.

The Texas Insurance of the Future

Many insurance products are already changing and premiums will continue to increase for property owners at risk of natural disasters. 2016 is likely to set a record with devastating hail hitting North Texas, the panhandle and central Texas in spring and early summer. Hail affects comprehensive coverage on vehicles and homeowner’s policies.

In addition to homeowner’s, floods in 2016 affected large areas of Houston, central Texas and the West. It’s only a matter of time, before a large hurricane hits the gulf and coastal areas.

And let’s not forget about risks of earthquakes. Oklahoma’s whopper of a 5.8 quake wasn’t related to climate change, but fracking. However, Texas could experience a similar magnitude quake in the next few decades.

Instead of predicting the next storm, let’s look at one insurance product already impacted by climate change.

The Problem with Flood Insurance

Most homeowner policies exclude flood damage. In fact, less than 25 percent of Texans carry flood insurance on their homes, according to the Insurance Council of Texas. With 367 miles of exposed coastline and the danger of flash floods in drought areas, these underinsured homeowners are taking a gamble.

Why do so few Texans carry flood insurance? Money, of course. Many homeowners who do have a separate flood insurance policy get it through the National Flood Insurance Program, offered by FEMA. However, the NFIP’s efforts to keep premiums down has landed it $24 billion in debt. The heavily subsidized program allowed many homeowners to buy flood insurance for close to $700 per year. But as the NFIP has begun raising premiums to claw its way out of debt, people are dropping flood insurance. The number of Texans with flood insurance dropped by 4.49 percent between 2013 and 2014.

In the event of flooding, the NFIP policy pays out up to $250,000 for a structure and $100,000 for personal possessions. So even with this policy, many homeowners are inadequately covered.

Some private insurers also offer flood insurance. Assurant Primary Flood Insurance just began offering coverage in Texas. Homeowners can buy structural coverage up to $800,000, plus $250,000 in contents coverage.

How to Prepare for a Future of Natural Disasters

Now is the time to review your insurance policies on your home, car and personal property. Assess your property’s current value, take into consideration the probability of more hail, wind and water damage, and make sure you’re adequately covered. Don’t forget any boats or vacation homes you might own, however humble. Keep in mind that flood insurance takes 30 days to go into effect. So if you want to protect your home, you’ve got to plan well before the weather forecast turns dire.

Need some help figuring out your ideal level of coverage? Give us a call and we’ll make sure you’re prepared for the insurance ramifications of global warming.