Twenty years ago, insurers could never have predicted today’s landscape. The rise of the internet, adoption of electric cars and the prospect of more and more data are becoming a reality. How will changes under the hood and technology affect auto insurance in the future?

The Rise of Telematics

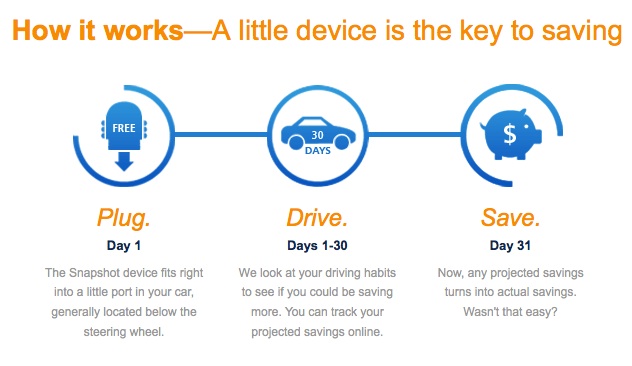

Anyone who uses telematics, or an internet connected GPS sensor, is adding a hidden backseat driver. Bad driving habits are tracked, reported and sometimes lead to higher rates. Safe driving habits can result in lower premiums. Insurers are expecting more drivers to have every turn, brake and acceleration scrutinized.

The upshot of telematics is that auto insurance is no longer a fixed cost, but a variable. Instead of costs being set by actuaries, insurance becomes more transparent. Usage-based insurance (UBI) means that a person’s actual driving behaviors translate directly to a policy. Other benefits include faster response time when accidents happen and quick tracking and recovery of stolen vehicles.

However, not everybody is on board! Some drivers view telematics as an invasion of privacy. UBI can also be expensive for insurers to implement and monitor. Check out our article we wrote for Safeco on telematics.

Still, UBI is growing fast. Approximately 70 percent of car insurers are expected to rely on telematics by 2020, according to SMA Research. More than 30 percent of government and commercial vehicles are already equipped as of 2017. Commercial adoption is higher, because it’s being required and not just by Uber and Lyft drivers. Truck drivers, fleet operators and sales professionals are now required to have telematics in the vehicle.

According to Insurance Business, “Once adoption hits over 50%, there will be a tipping point at which the use of telematics will be completely commonplace. Businesses that don’t use this technology will fall seriously behind their competition when that occurs.”

Current discounts for drivers using telematics range from 5 to 15 percent. That is, for good drivers. Bad drivers may find their costs rising by as much as 10 percent!

In the future, holdouts who don’t accept telematics could get penalized with a higher rate. Or it could even be a requirement to qualify, just like how a credit score has become mandatory when applying for insurance.

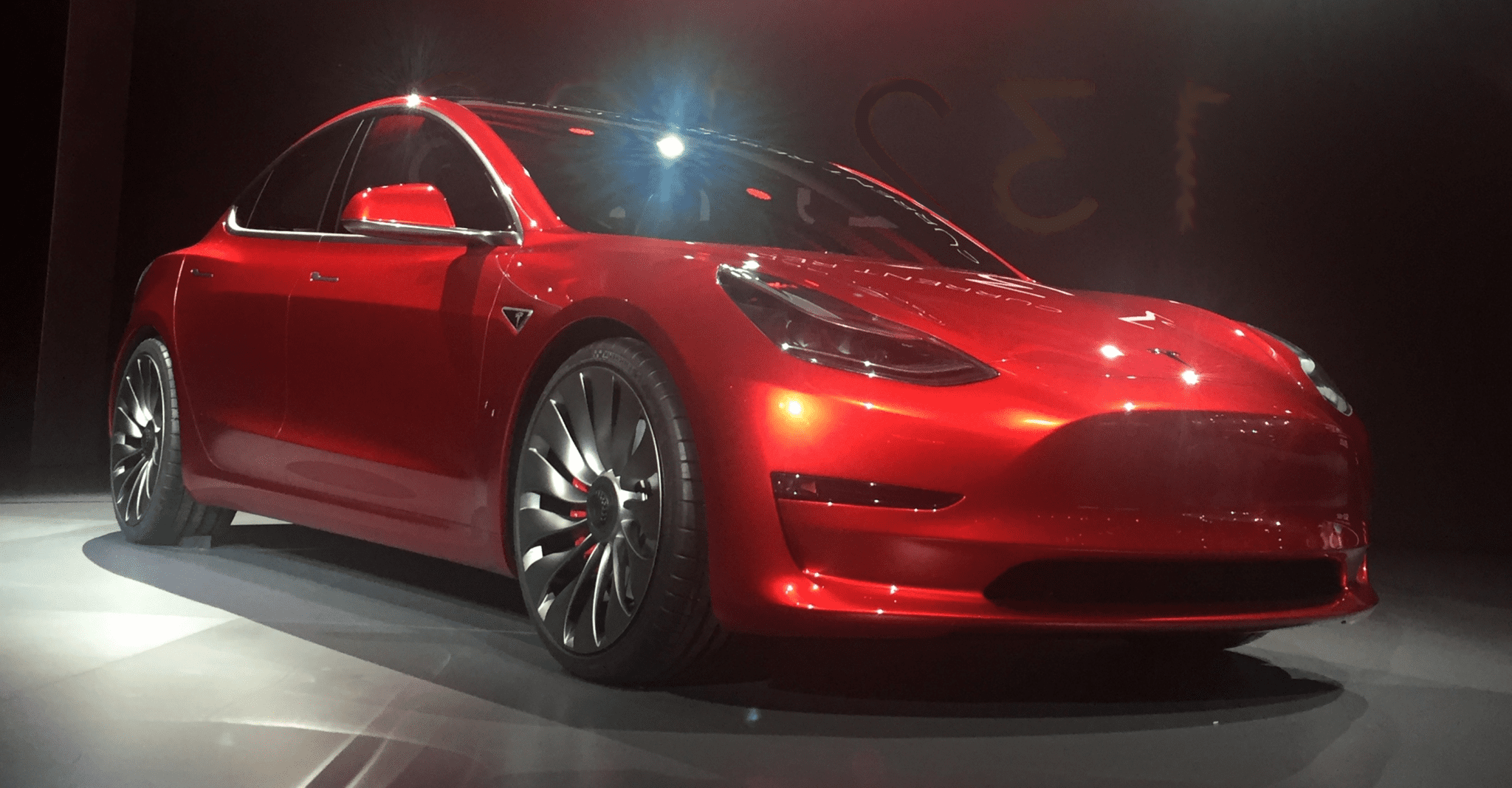

In addition to insurers, car manufacturers may install and require telematics in new vehicle purchases. Tesla Motors, although small in size as of 2018 is already building the Model S with advanced driving and mapping sensors. The electric car company has even suggested it could sell car insurance directly to vehicle owners. We recently wrote about the Model 3, and how premiums could increase before becoming more affordable.

Startup Disruptions

New insurance startups are shaking up the industry. Case in point: Lemonade. Co-founders Daniel Schreiber and Shai Wininger say they built their business model on behavioral economics and artificial intelligence. This two-pronged focus displaces fraud, conflict, paperwork and brokers.

Here’s how it works. Lemonade deducts a fixed fee from client’s monthly payments, pays for reinsurance and other expenses, and uses the remaining money to pay out claims. Unclaimed remainders are donated to causes chosen by a customer. Policyholders who favor the same cause are lumped together into peer groups, with their combined money paying the group’s claims. As Lemonade states on its website, “This way, our customers enjoy amazing insurance, and society gets a little push for the better. It also means that, unlike traditional insurance companies, we’re not in conflict with our customers, so we’re happy to pay claims fast and with no hassle.”

This new model especially appeals to millennial’s, who favor businesses committed to social good. In fact, 87% of Lemonade’s policyholders are buying insurance for the first time. The problem with this model is that preferred customers, such as middle-class homeowners, already have an agent. Lemonade’s bottom-of-the-market and millennial focus, lead to a high loss ratio. The word is out on whether it can last and save drivers money.

Electric Cars and Insurance

An influx of electric cars into the auto market is yet another challenge to auto insurers. Since auto insurance is based on facts such as crash damage and repair costs, it’s hard for insurers to set accurate rates with the little available data.

A

A

ValuePenguin study comparing four electric cars found wildly varying rates. While major insurers charged more for electric car policies than for old-school gas-guzzlers, this figure ranged anywhere from 1.07 to 1.45 times the cost. Mostly this is due to the higher replacement cost of electric cars. If they are preferred over gasoline vehicles, this cost may come down. It will certainly change as more data becomes available. If electric cars are as safe as manufacturers claim, insurance costs should drop over the next few years.

Fast Quotes and Accuracy

Geico was the first major auto insurer to promise quotes in 15 minutes or less. That timeline keeps speeding up. Now Safe Auto advertises a quote in three minutes or less. But what is lost when the quote speeds up? Is it possible to calculate discounts, savings and risks that fast?

Geico was the first major auto insurer to promise quotes in 15 minutes or less. That timeline keeps speeding up. Now Safe Auto advertises a quote in three minutes or less. But what is lost when the quote speeds up? Is it possible to calculate discounts, savings and risks that fast?

Realize that auto insurance quotes can’t keep getting faster and continue to be reliable and accurate. Quick quotes may also hide taxes and other costs. Consumers might be trading speed for accuracy. Spend a little more a time to get a quote that saves money, and remember it only needs to happen once a year.

Online Challenges

Many insurers are sacrificing the personal touch and moving to automation, technology and online quotes. As the American public becomes more comfortable tapping on devices than looking someone in the eye, this move feels natural and big insurers might look forward to the cost savings. But as more personal information migrates online, security and fraud escalates. Credit checks, financial info, health and accident data and other personal information are all difficult and costly to protect. How many big companies have been hacked already? Insurance companies are increasingly responsible for keeping data secure in an insecure cloud-based world.

Churn Rates

As impersonal technology adoption grows, loyalty becomes rarer. What customer feels the need to be faithful to a program that spits out online quotes? Fast rate quotes have supplanted quality, meaning customers whirl from the arms of one carrier to another. According to an article in Insurance Journal, the churn rate has risen 13 percent over the last few years.

What does this mean for auto insurance? The future is unknown, but it is changing and fast. At Hettler Insurance Agency, we enjoy adapting to change to better serve our customers.