Many people who don’t own commercial property would be surprised to learn that 60% of American commercial buildings are insured for terrorism. This means many ordinary building owners – not just high-profile targets – are purchasing coverage. In fact, while the country at large was shocked in 2015 by the 14 people killed in San Bernardino, the owner had the foresight to buy terrorism insurance. Since then, more mass shootings and instances of domestic terrorism has affected local communities and businesses.

Acts of terrorism – especially on “soft targets” such as the Boston Marathon and 2019 mass shooting at an El Paso Walmart – increase the purchase of terrorism insurance. The greater the supply of terrorism, the greater demand for terrorism insurance. A very sad, but true reality.

Terrorism Risk Insurance Act

President Bush first signed the Terrorism Risk Insurance Act (TRIA) into law in 2002. The act created a temporary program that would allow the insurance industry and the federal government to split the losses if there was a large enough terrorist attack. This is similar to flood insurance and the National Flood Insurance Program.

Since 2002, Congress and President Obama have extended and amended the act three times. President Obama signed the latest iteration in January of 2015, extending what is now the Terrorism Risk Insurance Program (TRIP) through 2020.

However, TRIP has not yet paid out. Damages from a terrorist attack must reach at least fifty million dollars to qualify, and then the U.S. Treasury secretary must certify that it was really an act of terrorism and therefore eligible for coverage. The Boston Marathon robbed three people of their priceless lives and 16 of priceless limbs, but the monetary price tag fell short. Instead, standard insurance policies covered the various types of losses in Boston.

Who Needs Coverage for Terrorist Acts?

Certain industries and locations face a bigger risk of being targets than others, although the San Bernardino example underscores that prediction is not a science. The highest risk of a terrorist attack is bustling commercial centers such as urban downtowns, airports and train stations.

Neither business owners nor insurance underwriters can accurately predict the need for terrorism insurance, although typical candidates include:

- Schools, especially colleges and universities

- Tourist destinations

- Airports

- Major Hotels

- Large corporations

- Construction companies

- Healthcare organizations and hospitals

- Neighbors of high-profile buildings

Property Casualty 360 surveyed 17 different industries in 2014. They found the industries purchasing terrorism policies most frequently were education followed by financial, real estate, technology and telecommunications. Seventy-four percent of companies in the Northeast purchased terrorism insurance as part of their property insurance, while only 54 percent of those in the South and West invested in terrorism insurance. According to Marsh, a global leader in insurance brokering and risk management, more than 52 percent of Texas building owners have terrorism insurance.

What is Included in Terrorism Insurance?

Property owners who are considering terrorism insurance need to read documents carefully. A commercial property policy should cover destroyed or damaged buildings, furnishings, inventory and equipment, and possibly the interruption of business. It may also cover associated liability claims against the business. But it will probably exclude chemical, nuclear, radio logical and biological attacks, as well as any post-attack fires (such as those caused by an explosion). While a terrorist attack might have a cyber element, terrorism insurance won’t cover cyber-attacks. For that, you need a separate policy for cyber liability insurance.

Also, many policies only pay if the U.S. Department of the Treasury certifies the incident as an official act of terrorism. Since this has been rare, standalone terrorism insurance policies are new options that provide additional protection and coverage regardless of being “officially certified” as a terrorist act. There are also active shooter insurance policies which provide coverage when the motive of a shooter isn’t clear, yet still results in a large loss of life and injury.

Premiums usually range from $19 to $49 dollars per million dollars of coverage annually, or 3 to 5% of the average company’s property insurance cost.

Recent Acts of Terrorism in Texas

August 3, 2019: A mass shooting targeted a Walmart in El Paso, busy with Latino shoppers preparing for back to school. Early reports indicate 22 dead and dozens injured. The attack was motivated by hate towards Hispanic immigrants, published online as a manifesto. Federal authorities are treating the shooting as a case of domestic terrorism, unknown is whether it will be certified as an official Act of Terrorism.

May 18, 2018: A school shooting affected a High School in Santa Fe, Texas and left 10 dead and 13 wounded. The shooter did not have a terrorist motive and the event was not certified.

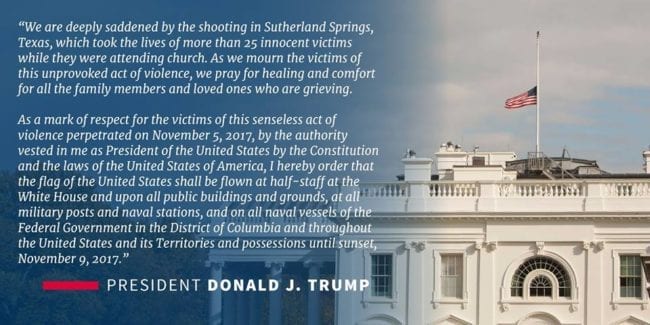

November 5, 2017: A mass shooting occurred at a church in Sutherland Springs, Texas killing 26 and injuring 20. The shooter did not disclose a motive and it was later ruled as not a terrorist incident, mostly as it did not follow a political or ideological agenda.

May 17, 2015: Two bike gangs in Waco, TX engaged in a deadly shootout at a Twin Peaks restaurant parking lot. 9 bikers were killed and 18 others were injured.

Despite grabbing headlines across the country, the shootout was between two domestic bike gangs and doesn’t qualify as an act of terrorism.

May 5, 2015: Two shooters that were allegedly influenced by ISIS wounded a security guard in Garland, TX

This attack would have been certified by the U.S. Department of the Treasury if the damage caused was greater than 5 million. It would also need to be proven that the shooters were influenced by ISIS, otherwise a standard commercial policy provided coverage.

Nov 5, 2009: a mass shooting took place at Fort Hood, near Killeen, TX. A U.S. Army major killed 13 people and injured 30 more soldiers.

Despite the seriousness of the attack, the crime was declared a mass shooting caused by mental illness, not terrorism.

Feb 28, 1993: Cult members in Waco, TX killed 4 ATF agents and injured 16 when federal agencies stormed the compound.

Similar to above, this act was not declared an act of terrorism, but a case of religious extremism.

Do You Have a Choice?

Opting into terrorism insurance is your decision and isn’t required by the State of Texas. As a business or building owner, coverage can be added to any commercial property policy. However, some carriers and insurance agencies require terrorism insurance with general liability policies. Despite the risk of an attack remaining small, no company should force your hand to buy a policy.

Choose terrorism insurance on your own terms. Using an independent agent like Hettler Insurance can give you more selection between commercial property carriers.

Opt into Terrorism Insurance if:

- Your business/building is high profile and could be the target of a foreign attack

- Your business/building is located in a major metropolitan city in Texas: Houston, Dallas, San Antonio, El Paso and Austin would be more likely targets.

- Your business/building is close to a possible terrorist target, most likely a federal building, sporting arena, conference center, etc.